Some Known Factual Statements About Which One Of These Is Covered By A Specific Type Of Insurance Policy?

Some Known Factual Statements About How To Become An Insurance Adjuster

You've heard the words before: Copayment. Deductible. Premium. A thousand others. You sort of get what they indicate and you sort of do not. But you do understand that if you get another medical billdespite having insuranceyou're going to shout. Attempting to comprehend medical insurance can be like diving into quicksand: No matter what you do, you constantly feel like you're sinking.

Medical insurance is really quite basic if you have the ideal dictionary. To understand health insurance, you first have to comprehend one essential element of the medical insurance business: Health insurance coverage business are only successful if they have money sitting on ice. Their organization design depends upon having a complete reserve of money.

If you can do that, you've got this. Prepared Here are some nuts and bolts of medical insurance: That's the regular monthly charge you pay to keep your insurance coverage going. Sort of like the regular monthly bill you pay to keep your internet service going. And you need to pay it whether you go to or not, otherwise they cut it off.

The health insurance company sets the rate depending on factors like your age, the size of your family, and where you live. That's the length of time your health insurance coverage business will cover your medical expenses, if you keep up with your premiums. Normally, it's a year. This is one of those "mouthful" words with a simple significance.

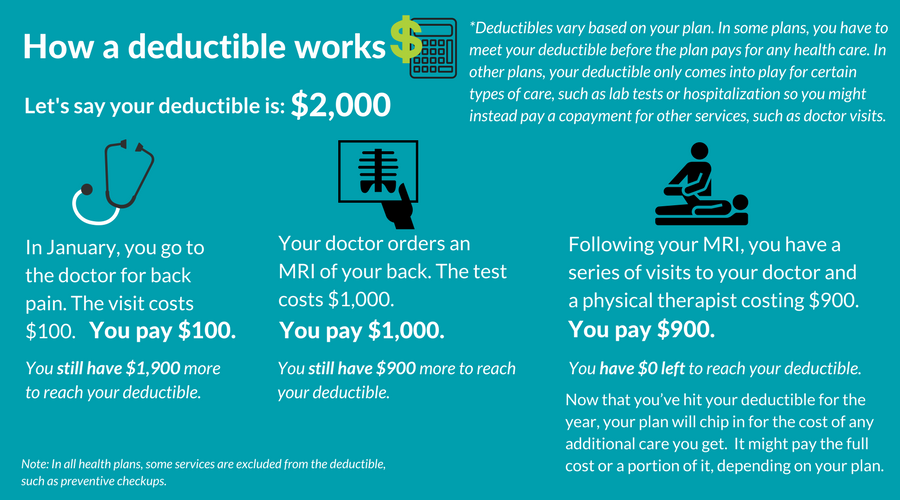

And yes, this is in addition to your monthly premium. Let's say it's January 1 and you've got the influenza. Your policy duration is one year, ending December 31, and your deductible is $500. You haven't utilized any health insurance coverage yet, however your flu medication costs $30. Think what? You need to pay that $30.

After that, the medical insurance company starts spending for some or all of it. A high monthly premium typically indicates a lower deductible. And on the other side, a low month-to-month premium typically suggests a higher deductible. Yep, this is another charge that comes out of your wallet. This is a flat cost you pay as quickly as you walk into the medical professional's office for medical services.

The Basic Principles Of How To Become An Independent Insurance Agent

Or you may pay $300 to go to the emergency department. When you make a copayment, will it be subtracted from your deductible? Normally yes, however it depends upon your policy. Ask your health insurance provider for more details. This word is both excellent news and problem. If your health strategy has coinsurance, that suggests that even after you pay your deductible, you'll still be getting medical costs.

You've gotten enough medical services to pay the full $500 deductible. So, although you don't need to stress over a deductible any longer, you now have to pay coinsurance. Coinsurance is a way your insurance provider divides the expense of your care with you. For example, they might pay 80% of the bill while you pay 20%.

You see an orthopaedist (a bone professional). He charges you $200. If you have 80-20 coinsurance, your insurance coverage company will say: That suggests https://finnbqmj42245.carrd.co/ the insurance business pays $160, and you pay the rest, $40. Here's the bright side: Coinsurance in some cases even "kicks in" before you satisfy your deductible. Your insurance provider may make that occur for specific treatments or tests.

Also, you won't need to pay coinsurance permanently. At some point, your insurer will start paying 100% of your expenses. This is when you have actually reached your: That's the total amount you'll have to pay out of pocket during your policy period. It may be $5,000 or it may be $15,000.

Now, $15,000 might appear high - how do i know if i have gap insurance. However when you remember that something like cancer treatment might cost $100,000 a year or more, having medical insurance still safeguards you in the long run. Talk to the medical insurance service provider at your hospital about payment plans and forgiveness for medical expenditures.

A provider is someone who supplies health care. It can be: A medical professional A dental professional A chiropractor A midwife An eye specialist A psychologist A physiotherapist A nurse A nurse professional Why do you require to understand this? Two factors. The first reason is that some companies are less expensive than others. what does renters insurance not cover.

8 Easy Facts About How Long Can You Stay On Parents Insurance Explained

You may go to a walk-in clinic. There, you might see a nurse specialist (NP) a nurse who can do certain things a medical professional can, like recommend drugs. Or you might see a physician assistant (PA) someone who does numerous things a doctor does, recommends drugs, and works under a medical professional's supervision.

If you require care like an X-ray, and your coinsurance kicks in, you'll most likely pay less than you would at a hospital. Even if you're still paying complete price because you haven't met your deductible yet, an NP or PA will likely be method cheaper than a doctor. The 2nd reason is that your insurance business may not specify specific service providers as "service providers - how much do dentures cost without insurance." For instance, you may see a hypnotist who makes a world of distinction in your life.

But best way to sell a timeshare if the insurance provider does not consider her a healthcare service provider, they won't spend for your sessions with her. You'll keep paying complete cost out-of-pocket, forever. Another angle: Your insurer may accept spend for certain treatments or surgeries just if they're done by suppliers with specific credentials or certifications.

What's the bottom line? Ask the insurance business before you go to your visit if they'll spend for services from the company you wish to see. Here's the background: Insurance provider attempt to conserve money by making deals with specific companies. Those service providers lower their costs for clients who are covered by that insurance company.

If you see a medical professional who's "in-network," you'll pay less. If you see a doctor who's "out-of-network," you'll pay more. How do you understand if a doctor is in- or out-of-network? Call your insurance provider, or search their website. They'll probably have a tool you can utilize to search for different doctors.

However they have lower monthly premiums. One warningif you go outside the HMO network for your care, the insurance company usually won't pay for it, other than in an emergency situation. These networks have more companies to pick from. However they have higher regular monthly premiums. You can likewise utilize suppliers outside of the network, however at a greater expense.

Excitement About How Much Renters Insurance Do I Need

With suppliers in tier 1, you'll pay the least quantity of cash. If you go to a tier 2 company, you'll pay more, and in tier 3, you'll pay one click here of the most. A tiered plan may have a lower premium than a PPO strategy. These strategies can have really high deductibles (a number of thousand dollars or more), but they keep your premiums lower.

Benefits are the things your insurance plan covers. They can be: A blood test An X-ray Your annual physical Prescription drugs A hip replacement An emergency clinic see When the insurance coverage company says "you'll get a greater advantage level if you go to this physician, lab, or hospital" listen up. They're most likely trying to refer you to an in-network supplier.

The Basic Principles Of What Does Comprehensive Auto Insurance Cover

His copays extend to physical therapy check outs, where he'll pay $20 for each session. Leon's determined to get whatever back on track so he and Leah can go back to doing the important things they love: spending quality time together outdoors. By discovering how premiums, deductibles, coinsurance and copays work, you can much better understand your health care expenses.

Simply put, a deductible is the amount of cash that you need to pay by yourself behalf before your strategy will start and start to cover eligible medical expenses. The primary advantage of a deductible is that you will save cash on your premium. So the bigger the deductible, the higher the discount rate on your premium.

Other ways to conserve on your premiums include co-insurance, which is another alternative readily available on our MyHEALTH strategies in Asia. The simplest method to illustrate how deductibles work would be through some simple examples. If individual A has a deductible of $500 and required treatment equating to $4,000, then their insurance coverage would cover $3,500 after person A fulfilled their deductible.

What Is Group Term Life Insurance Fundamentals Explained

Person B has a deductible of $2,000 and needs treatment equating to $1,000. Nevertheless, later that year they require another treatment costing $5,000. In this case, person B would cover the $,1000 for the very first treatment and $1,000 of the 2nd, while the insurance would cover $4,000 of the second claim.

So it's constantly essential to inspect both the schedule of benefits and the terms and conditions of the strategy to make certain you totally understand how deductibles and any other premium conserving system work prior to you buy. Below are some methods deductibles might differ across plans. Sometimes, they might use to your plan as a whole, but in other cases deductibles only apply to particular benefits.

Usually, medical insurance deductibles are applied on a per term basis, or per duration of insurance coverage. This suggests that once you have actually fulfilled your deductible, all eligible expenses during the rest of that duration of insurance coverage will be covered, but that your deductible will reset at the beginning of the next duration of insurance coverage, assuming you have renewed your policy.

Get This Report on How Much Does Long Term Care Insurance Cost

Oftentimes, people get our MyHEALTH prepares as a way to top up or the protection supplied by an existing medical insurance policy they might have through their work or their spouse. This is to help cover qualified medical costs that the existing health plan would not have covered.

Not just will it help decrease your premium, however you can apply qualified expenses covered by your existing insurance coverage policy towards the deductible on your MyHEALTH strategy, even if it is completely covered by the existing policy. Many health insurance plans will offer a range of deductibles to match various individuals's financial and protection needs.

For example, our MyHEALTH plans offer global coverage, but are customized for people residing in different countries to better suit their everyday health care requirements. how much does home insurance cost. Therefore, different plans provide various deductible levels based upon the local insurance coverage market and healthcare system. MyHEALTH Hong Kong MyHEALTH Singapore MyHEALTH Thailand MyHEALTH Vietnam MyHEALTH Philippines NilUSD 1,500 USD 5,000 USD 10,000 NilSGD 2,000 SGD 5,00010,000 NilTHB 16,375 THB 32,750 THB 81,875 THB 163,750 THB 327,500 NilUSD 500USD 1,000 USD 2,500 how to cancel bluegreen timeshare USD 5,000 USD 10,000 NilUSD 500USD 1,000 USD 2,500 USD 5,000 USD 10,000 Searching for comprehensive worldwide health insurance protection in Asia? APRIL International offers a variety of strategies that offer worldwide protection to people residing in Asia, supplying flexible protection to expats and local nationals alike.

How To Get Therapy Without Insurance for Dummies

We likewise offer group medical insurance strategies for companies of every size, from SMEs to large multinationals. You can click the links listed below for additional information on your alternatives.

Getting medical treatment can be pricey because, wellhealth insurance. Those bills can skyrocket in a brief amount of time if you need healthcare, depending on what your insurance coverage will and will not cover. However what about medical insurance deductibles? How precisely do they work? And how can you make them work much better for you and your family? We'll direct you through the world of health insurance deductibles, explain the various types, and describe what makes one of the most sense when it pertains to deductibles and health insurance.

A medical insurance deductible is the amount you're responsible for paying prior to your medical insurance company starts to share a few of the cost of medical treatment with you. Medical insurance, like any other kind of insurance, includes a monthly or yearly premium the quantity you routinely pay to be insured in the first place.

Some Known Details About What Is A Whole Life Insurance Policy

And that deductible is in impact for the whole year up until it's time to renew or register again. You define your deductible quantity when you register in your medical insurance plan during the registration duration. Let's pretend you have a health insurance strategy with a $1,000 deductible. If you have an accident or develop a disease and need medical treatment, you'll have to pay for the very first $1,000 in medical expenses.

It's great to bear in mind that with the majority of insurance plans, you're able to receive certain regular and preventative health care services (like screenings or immunizations) as standardregardless of whether or not you've met your deductible. is the term used to explain how your medical treatment is paid after you've reached your deductible quantity.

Just how much do I pay in coinsurance? It's a percentage amount depending upon your insurance plan. If you've met your deductible and your coinsurance obligation is 30%, that suggests your medical insurance supplier will pay 70% of each future bill until you fulfill your out-of-pocket optimum for the year.2 See more below.

Some Known Details About How Many Americans Don't Have Health Insurance

It's a fixed amount decided by your specific medical insurance plan. Copays are different than deductibles and coinsurance since you pay a copay whether or not you have actually met your deductible. A copay for a basic journey to your medical professional can be different than a copay for specialized services like physiotherapy, for instance.

An out-of-pocket maximum is the maximum amount your health insurance strategy says you have to pay forcovered health services throughout the year. This figure originates from your deductible, your coinsurance duty and your copays. If you reach this out-of-pocket maximum, then your insurance coverage business pays 100% of your remaining covered medical costs for that year.

Deductibles can can be found in various types depending on the kind of insurance plan you have! Here are the various kinds of health insurance coverage deductibles: Comprehensive deductibleA extensive deductible is a deductible quantity that applies to and consists of all of the medical protections in your medical insurance plan. When you have actually met this extensive deductible, your plan's coinsurance will take effect.

How Much Is Urgent Care Without Insurance for Beginners

Your plan might supply some health services without you having to consume into your deductible. Woo-hoo! Once again, examine to see if the protections without a deductible are advantageous to you. Individual or household deductibles: Your member of the family might have individual deductibles, or the strategy Helpful resources might just have one family deductible. Remember, thanks to the Affordable Care Act, specific preventive care is 100% covered by all non-grandfathered health plans. You do not need to pay any deductible, copay, or coinsurance for covered preventive healthcare services you obtain from an in-network company. Once you meet your out-of-pocket optimum for the year (including your deductible, coinsurance, and copayments), your insurer https://diigo.com/0k1n94 pays 100% of your remaining medically-necessary, in-network costs, presuming you continue to follow the health plans guidelines regarding prior permissions and recommendations.

Your out-of-pocket costs for health care services that aren't a covered advantage of your medical insurance won't be credited towards your health insurance coverage deductible. For instance, if your medical insurance doesn't cover cosmetic treatments for facial wrinkles, the cash you pay of your own pocket for these treatments won't count towards your medical insurance deductible.

There are exceptions to this rule, such as emergency care or situations where there is no in-network provider capable of supplying the needed service. Federal rules need insurance companies to count the expense of out-of-network emergency situation care towards the client's routine in-network cost-sharing requirements (deductible and out-of-pocket optimum) and prohibit the insurer from enforcing greater cost-sharing for these services.

Some Ideas on How Much Is Adderall Without Insurance You Should Know

( That's presuming the state law uses to the person's medical insurance; self-insured plans are not regulated at the state level, and they account for the majority of employer-sponsored coverage.) Health plans that allow out-of-network care, typically PPOs and POS strategies, might differ regarding how they credit money you spent for out-of-network care.

In this case, cash spent for out-of-network care gets credited toward the out-of-network deductible, however doesn't count toward the in-network deductible unless it's an emergency scenario. One caveat: if your out-of-network company charges more than the traditional amount for the service you got, your health plan might restrict the amount it credits towards your out-of-network deductible to the traditional amount.

Copayments typically do not count towards the deductible. If your health plan has a $20 copay for a primary care workplace check out, the $20 that you pay will most likely not count towards your deductible. Nevertheless, it will count towards your optimum out-of-pocket on practically all plans (some grandmothered and grandfathered plans can have various rules in regards to how their maximum out-of-pocket limits work).

An Unbiased View of What Is The Best Medicare Supplement Insurance Plan?

In reality, premiums aren't credited towards any kind of cost-sharing. Premiums are the expense of buying the insurance. They're the price you pay the insurance provider for assuming part of the financial threat of your possible health care expenses. You have to pay the premium monthly, no matter whether you need health services that month or not.

For a growing number of Americans, high deductible health plans are a truth of life. The pattern began a decade back and shows no signs of disappearing. At numerous firms, it's the sole medical insurance that's used for staff members. The assumption is that if employees have to shell out more cash when seeing a physician or filling a prescription, they will have "skin in the video game" so they'll use their healthcare advantages more selectively and avoid wasteful or unneeded procedures and drugs.

Field who is also a speaker at Wharton. Wharton healthcare management teacher David Asch gives the example of going out to dinner on your own penny versus a cost account. You'll naturally be more prudent, states Asch, who is likewise executive director of Penn Medication's Center for Healthcare Innovation.

What Happens If I Don't Have Health Insurance - An Overview

Furthermore, high-deductible strategies increase companies' bottom line by shifting more costs to the employee. The Internal Revenue Service currently specifies a high-deductible health plan as one with a deductible of a minimum of $1,350 for a private or $2,700 for a family, according to health care. gov. Field keeps in mind that many deductibles remain in the variety of $5,000 to $6,000.

On the positive side, people's month-to-month premiums are generally lower. The plans have gained popularity amongst organization owners. In 2014, 41% of consumers with employer-provided coverage had specific deductibles higher than $1,000, up from 22% in 2009, according to the Quarterly Journal of Economics. Moreover, the share of companies using only high-deductible coverage increased noticeably from simply 7% in 2012 to 24% in 2016.

Field includes, "People truly resent those plans where they feel that it appears like insurance, but it actually isn't due to the fact that you have to set up so much of your own money." Some significant business have actually started to backpedal, including JPMorgan Chase and CVS, according to a post last year in the Insurance coverage Journal.

How Long Can You Stay On Parents Insurance Can Be Fun For Everyone

CVS, which had switched all of its workers to high-deductible strategies, realised that some employees had actually stopped filling vital prescriptions and was apparently re-evaluating its policies. "You would not want me to utilize a costly brand-name drug for my heartburn when I might use a much more economical generic [On the other hand,] you don't desire me to stop taking my insulin.

And some are examining whether their use might assist decrease America's breakneck medical spending. "With health care costs increasing faster than [the U.S.] GDP, reducing the growth rate is a primary health policy goal," write Leonard Davis Institute associate fellow Molly Frean and Wharton health care management teacher Mark Pauly in a recent National Bureau of Economic Research study working paper, "Does High Cost-Sharing Slow the Long-lasting Growth Rate of Health Spending? Proof from the States." They, too, keep in mind the extensive usage of high-deductible health insurance: in 2018 the percentage of workers with a basic annual deductibles reached 85%, and their average deductible was $1,573 for private protection.

Gupta, Field, and Asch all believe that the concept of high-deductible health insurance may hold promise for reducing total expenses, however not considerably, at least in their current form. "I think it's one tool, however overall it's not going to be a game-changer," Field states. Gupta agrees, adding that while research study on these plans has actually revealed that people do cut back on care, "the decrease isn't really large it's [just] on the order of 5% to 10%." The share of employers using just high-deductible coverage increased significantly from simply 7% in 2012 to 24% in 2016.

What Is A Premium In Health Insurance Things To Know Before You Get This

Another issue with high-deductible strategies is whether they really lead people to make great decisions about when they require a doctor and when they don't. Asch states this is a significant problem: Many people simply do not have the medical know-how to compare high-value and low-value care. "You would not want me to use a pricey brand-name drug for my heartburn when I could utilize a much less expensive generic," he says.

However high-deductible health insurance do not discriminate between those 2 buying decisions." They rely on the patient to make the call, he says, and while some people can do that successfully, numerous can not. To make things much more complicated, he states, the costly drugs are the ones that get promoted straight to consumers, spurring demand for them.

Not known Facts About How Much Does A Dental Bridge Cost With Insurance

The financial investment, however, will probably be higher. Knowledgeable insurance experts like manufacturers or captive agents start most independent firms due to the fact that it's easier to start a company with experience (how to get a breast pump through insurance). At that point, you currently have the item knowledge, sources, an established reputation, and the confidence to prosper from your very first try.

First, the number of Agency Aggregators have substantially increased in the last 5 years https://www.canceltimeshares.com/blog/how-do-i-cancel-a-timeshare/ and they want your subscription. Second, technology such as Company Management Systems, is now economical and makes running your agency very effective. Both of these products are dealt with on in this guide. The market has truly filled deep space and what wasn't readily available years ago is readily available today.

The start-up expenditures for an independent firm should be allocated and carefully planned for. If a potential company owner does refrain from doing this, it can trigger the failure of the agency. You can not pay for an absence of operating funds needed to unlock and keep the company running for the very first couple of years. how much homeowners insurance do i need.

Insurance coverage, consisting of E&O, Plan, Employee Comp and Bond. Rent Down Payment and First Month's Rent. Initial Aggregator Charge (not all groups charge this). Workplace Computers and Printers. Office Furnishings. License costs, consisting of Insurance Agency License and any required company licenses (how to get dental implants covered by insurance). Legal costs if you prepare on establishing a Partnership, LLC, or Corporation.

What Happens If You Don't Have Health Insurance Fundamentals Explained

The resulting overall start-up expense can range from at least $5000 to $40,000. The lower quote presumes bare minimal cost circumstances from discovering an aggregator without initiation costs to purchasing used furniture. Nevertheless, finding a group that doesn't charge a cost may or may not be the very best choice for your circumstance.

You require to prepare ahead of time for what it will cost you to open your agency doors, keep enough in reserve to pay costs up until you break even, and still have enough in cash reserves to manage your living expenses. Unless you have a book that you are all set to roll or a system in place that generates lots of accounts within the first year, this procedure can take numerous years.

You will need to cover these expenditures from savings up until your commissions can cover them. Throughout this short article we utilize different facts and figures, here are the sources.

Are you a resourceful type of individual who has always wished to begin your own insurer? It's not as easy as it utilized to be, but if you have enough drive and decision, anything could be possible. You'll just have to work hard to make it happen. Here are all the information on what to do.

Some Ideas on When Is Open Enrollment For Insurance You Should Know

They begin as insurance coverage agents for other companies to discover the trade. This is a profitable chance due to the fact that everybody requires cars and truck insurance and numerous individuals like to work with an agent who is absolutely devoted to them and their requirements all the time. In every state, there are various requirements for getting a license to sell insurance.

You should get accredited to offer as many types of insurance coverage as possible including property, casualty, life, health and annuity insurance. This will open you approximately as numerous prospective clients as possible. how long can children stay on parents insurance. Thankfully, licensing classes are usually readily available through online classes and at local neighborhood colleges, so it's not too difficult or pricey.

If you've been imagining becoming an insurance agent there are truly no reasons! The next action in setting up your own insurance business would be to identify your start up expenses. Lots of entrepreneur get an organization loan to assist cover the costs, however others have a lucky inheritance or other savings, or perhaps a generous relative who pays the bill.

You will likewise require to consider expert company services like accountants and tax specialists. Deal with your accountant to learn how much you will require to cover expenditures and make a company plan so you can have a great idea of when you can in fact expect to pay off the loan.

The 4-Minute Rule for What Does Renters Insurance Not Cover

It will also help you to secure a loan if you choose to go that route to fund your company. It might be truly hard to discover the best workplace for you. You must look around at various commercial spaces to see if there is a workplace out there.

When you start your own insurance coverage company you will absolutely require some IT support. There are a number of insurance company content management systems and consumer relationship supervisors that will help you run your organization efficiently. A few of the leading items to try consist of Salesforce, Hubspot, and Agency Bloc. The latter specifies for any type of organization that runs as a company, including an insurance firm.

Some top insurer like Farmers usage a minimum of among these to track leads and client relationships which leads to benefits and more success. When you are an insurance coverage agent you have a few different alternatives when it comes to which products you choose to offer. You can either work for one insurer or multiple companies and represent whatever products you think are the finest.

Lots of companies provide you with materials and other https://www.timesharetales.com/blog/wesley-financial-group-llc-reviews/ details on how they would like you to talk about their items. It's truly easy since the insurance companies wish to make it easy to sell their products. When you start as an insurance coverage representative you can purchase certified leads from different sources, or you can completely go back to square one. what is a premium in insurance.

The 45-Second Trick For How Much Is Car Insurance A Month

If you want to have an existing book of company to begin you might find that you have a little bit of a much easier time getting clients initially. Beginning a new business can be a bit demanding but if you begin with an upper hand you may have a simpler time.

They can make anywhere from $26,000 up to over $100,000. All of it simply depends on where you live and your overall level of success. The average salary for insurance representative is around $50,000. This is more than the average american income of simply around $25,000 annually, so it is in fact a truly good career option.

Between 2012 and 2022 it is expected to have actually grown about 10%, meaning that raise at a quite constant clip of about 1% per year. That's pretty excellent compared to other markets that are refraining from doing quite so well. Are you ready to end up being an insurance company or start your own insurance service? It truly is a fantastic choice since people will always require insurance of differing types as long as mishaps and natural catastrophes take place.

More About How To Become An Insurance Broker

Last Upgraded on October 27, 2020 So you're an excellent chauffeur. You have actually never ever remained in an accident. You've never ever even made a claim on your cars and truck insurance coverage. Why are you paying a lot for cars and truck insurance? There are a variety of reasons that your insurance may be so high without any mishaps.

Often, you're legally paying excessive. In other cases, insurers are charging a competitive price for your policy and you just do not comprehend how insurance coverage pricing works. The rate of your car insurance coverage has to do with more than just your driving history. You may have a clean driving history yet still pay substantially higher premiums than someone with an accident-filled driving history.

This consists of any mishaps or occurrences from your past. If you have actually never ever had an accident, then you might still pay high costs because of previous speeding tickets or traffic violations. Your Driving Activity: How far do you drive to work every http://simonnpcc943.fotosdefrases.com/excitement-about-why-is-my-car-insurance-so-high day? The number of miles do you place on your lorry every year? The more you drive, the riskier your driving activity is.

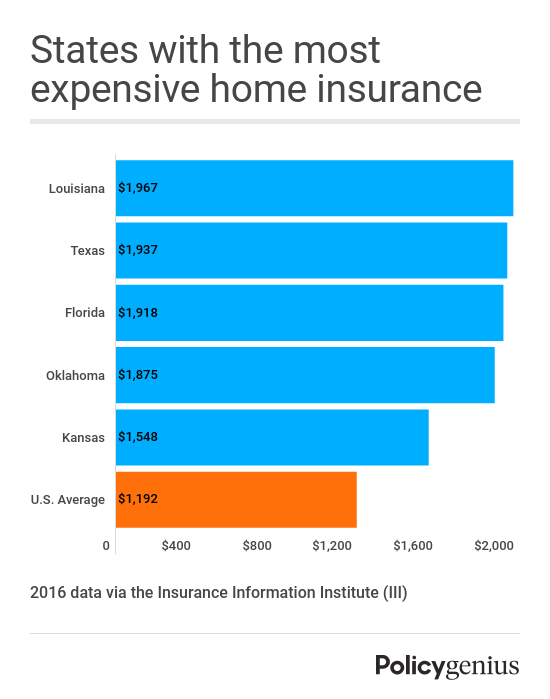

Your insurer might ask to see your credit rating, including your financial obligations, tax liens, personal judgments, and medical costs. Your Area: Motorists in some states pay substantially more than drivers in others. We're not simply speaking about drivers in rough winter climates. Chauffeurs in Louisiana, for instance, pay a few of the highest insurance rates in the country.

Your Demographic Data: Your sex, age, and marital status all impact your insurance coverage rates. These factors are generally beyond your control. Nevertheless, your insurer will take a look at historical driving data to select a fair rate for your insurance strategy. If 23-year-old male motorists are a higher risk group than 58-year-old female drivers, then younger male chauffeurs will pay more for car insurance.

6 Simple Techniques For How To Get Rid Of Mortgage Insurance

The type of automobile you drive has a huge effect on the price you pay. If you're driving a $200,000 luxury car, then you're going to pay a higher price than somebody driving a $10,000 economy lorry. Your Policy Options: What's covered on your insurance plan? Just how much are you spending for your deductible? Did you select a low deductible and a high regular monthly premium? Did you purchase an extensive policy with all of the bells and whistles? Or did you pick a cheaper strategy with the minimum liability protection? The type of policy you select and the choices on that policy will have an extensive effect on the price you pay.

Here are a few of the reasons why you may pay high cars and truck insurance prices without any accidents: You have a horrible driving record, including points-related offenses like speeding tickets or traffic infractions You have a history of big claims (someone who has made claims for three minor car accident, for example, might pay lower rates than someone who has actually amounted to one vehicle) You have a long commute and/or put a great deal of miles onto your lorry every year You have a poor credit report You have actually canceled vehicle insurance coverage in the past You have a DUI or other similar offense You're a young, single male You reside in a state or region with high insurance coverage premiums You're driving an automobile that's viewed to be risky or riskier than an ordinary car (smaller sized cars tend to be associated with more mishaps than a Prius, for example) You're paying too little for your deductible You're paying for more protection than you require You're not bundling insurance strategies together Someone has stolen or abused your identity (someone might have supplied your chauffeur's license or personal information when they were caught speeding, for example, or there may be other record-keeping mistakes in your driving history) Some states have higher insurance premiums than others (why is my car insurance so high).

That's why chauffeurs in Ohio pay around $1,050 per year for car insurance, usually, while the average driver in Michigan pays over $2,800 annually. The most expensive states for car insurance coverage in America for chauffeurs with a tidy record (or any driving record) consist of: Michigan: $2,864 per year Louisiana: $2,412 annually read more Florida: $2,389 each year Texas: $1,983 per year California: $1,981 annually Georgia: $1,932 each year Rhode Island: $1,931 each year Colorado: $1,898 annually Connecticut: $1,892 annually Delaware: $1,888 per year All rates above are based on estimated insurance premiums for a middle-aged driver without any mishaps.

A clean driving record with no accidents will reduce vehicle insurance coverage premiums in all states. Although car insurance coverage might seem costly in states like Michigan and Louisiana, motorists with mishaps on their record will pay even higher rates so be glad you have a tidy record without any accidents. Particular age groups pay greater rates for cars and truck insurance.

Even if you have a clean record with no mishap, you pay higher rates for automobile insurance coverage due to the fact that you have actually limited driving experience and little insured driving history. You might go your entire driving career without a single accident or you could cause numerous at-fault accidents prior to age 25. The insurer knows absolutely nothing about you, so they err on the side of caution by charging greater rates to more youthful drivers.

The Main Principles Of How To Get Insurance To Pay For Water Damage

As a teenage motorist, you pay the greatest possible automobile insurance how to get rid of a timeshare legally coverage rates in the majority of states, even if you have a tidy record. Motorists who buy their own cars and truck insurance at age $116, 17, 18, or 19 might pay $4,000 or more each year for full coverage automobile insurance coverage. All drivers under 25 pay high rates for cars and truck insurance coverage, but teens are penalized particularly harshly.

Cars and truck insurance premiums drop every year you go without a mishap. After age 25, automobile insurance coverage premiums drop considerably every year till you're in your 30s. Vehicle insurance rates continue to decrease in your 30s, 40s, and 50s, assuming you maintain a tidy record. In your 50s and 60s, you pay the least expensive possible rates for vehicle insurance as a driver with a tidy record.

Statistically, older chauffeurs are more most likely to trigger mishaps than chauffeurs in their 50s and 60s. Anticipate vehicle insurance premiums to increase a little as you grow older and continue to drive. Some states have actually passed laws forbidding insurance provider from raising premiums on older drivers with a clean record, although you may need to pass a driving test to verify your ability and prevent higher premiums.

While some insurance coverage companies charge high rates to younger drivers, others welcome younger motorists to stabilize the insurance coverage pool. Even if you have no mishaps on your record, you could pay high insurance premiums. In fact, you may pay higher rates for automobile insurance coverage than a motorist with an at-fault accident due to factors like credit score, speeding tickets, and more.

Nevertheless, motorists with several speeding tickets or a single serious speeding offense might face greater insurance premiums. Statistically, speeding increases the chances of a mishap, and insurance business raise rates to cover this added risk. Reckless Driving: Negligent driving is a major offense. Some insurer deal with reckless driving convictions as seriously as DUIs, although it differs depending upon your state and insurance provider.

The Greatest Guide To How To Cancel State Farm Insurance

That's since some insurer might increase your cost a lot, but others may not, depending on their unique underwriting solutions for rates policies. how much does an insurance agent make. Geico has the most affordable rate for chauffeurs with bad credit. If you're searching for inexpensive automobile insurance coverage with bad credit, you'll see in the table below how business compare.

Aside from contrast shopping, keeping dings off your credit report and sustaining a high credit score is among the finest ways to get and keep budget friendly vehicle insurance coverage rates. Motorists with poor credit pay an average of 71 percent, or about $1,000 more for insurance coverage than those with great credit, according to CarInsurance.

That's higher than the premium hike (32 percent) for an at-fault accident that hurts someone. CompanyGood credit ratePoor credit rate% boost$ increaseGeico$ 1,109$ 2,09485%$ 986Nationwide$ 1,598$ 2,24441%$ 646Progressive$ 1,483$ 2,64477%$ 1,161 Allstate$ 1,868$ 2,90656%$ 1,038 State Farm$ 1,400$ 3,012113%$ 1,613 Farmers$ 1,753$ 3,03978%$ 1,279 Geico has the least expensive rate after a speeding ticket (exceeding the limit by 11 to 15 miles per hour) among insurance companies researched by the professionals at CarInsurance. com. Tickets for moving violations impact what you pay for car insurance, so part of keeping expenses low is maintaining a clean driving record.

Normally, it means greater rates if you have actually had a current moving violation, such as a speeding ticket. However, each company evaluates danger differently, so even with driving violations on your record, you'll conserve if you compare car insurance provider. Let's break down typical boosts for speeding tickets by company: Inexpensive For Motorists with Speeding TicketsCompanyAverage RateRate After Speeding Tickets% boost$ increaseGeico$ 1,109$ 1,41928%$ 309State Farm$ 1,400$ 1,62415%$ 225Nationwide$ 1,590$ 1,88319%$ 293Progressive$ 1,509$ 1,93530%$ 426Farmers$ 1,624$ 1,95022%$ 325Allstate$ 1,868$ 2,23319%$ 364Cheap vehicle insurance coverage after a mishap claim comes just by comparing rates.

The data listed below is for a recent mishap claim for residential or commercial property damage over $2,000. 6 Most Inexpensive Automobile Insurance Provider for Motorists after AccidentCompanyAverage RateRate after accident claim% increase$ increaseGeico$ 1,109$ 1,57843%$ 469State Farm$ 1,400$ 1,67019%$ 270Progressive$ 1,483$ 1,81622%$ 333Farmers$ 1,663$ 2,30138%$ 638Nationwide$ 1,598$ 2,51357%$ 915Allstate$ 1,868$ 2,63141%$ 762To save cash, drivers on a budget plan are frequently on the hunt for insurance protection that they can get at a low cost (or low-cost) that does not require a first payment (or deposit).

That's because the first payment is in some cases a bit more than the rest of your regular payments. The term "no-deposit insurance coverage," is not a main type of coverage or policy. Rather, the term is used by motorists looking for vehicle insurance protection that won't need an expensive very first payment. Here's how it works: you must constantly make a payment to the vehicle insurance provider to put your protection into result.

The 15-Second Trick For Which Of The Following Best Describes Annually Renewable Term Insurance

In a lot of cases, the very first payment will be more pricey than subsequent payments, and this is what is referred to as deposit or down payment. Comparing vehicle insurance coverage rates can help you save hundreds of dollars. That's because each vehicle insurance provider uses its own formula to determine rates. This suggests the same policy can have prices that differ substantially amongst insurance providers.

Penny Gusner, senior customer expert for CarInsurance. com, suggests comparing vehicle insurance prices estimate to discover the least expensive rates a minimum of when a year-- however definitely at these times, when your rates are most likely to alter drastically: Buying a carPutting cars and trucks on a multi-car insurance coverage policyAdding or removing a chauffeur from a policyMarriage or divorceMovingAdding a teen driverBuying a houseDUI or significant violationAccidentChange in credit scoreThere are a variety of ways to buy inexpensive car insurance, the simplest is online.

You can get matched to carriers from a website like CarInsurance. com that connects you to several insurance companies, or if you choose, you can visit automobile insurance provider websites. In either case, you can get quotes quickly so you can compare costs and determine which business is the most cost effective that best fit for your requirements.

You can also print out your cards or have them downloaded to an app. If you prefer speaking to an agent, looking into cars and truck insurance online is still an excellent idea. That method, you can limit your options to the leading three business, based on prices and other factors that are very important to you, and sell my timeshare reviews worst timeshare companies then you can call an agent to purchase or get more information.

" Keep in mind through the entire purchasing process that rate might be essential, but it must not be the only variable you look at," states Gusner. "You may wind up with a policy that is so bare bones that you still have to pay out of pocket even after suing." Low-cost might benefit your wallet however does not suggest it will be the right suitable for your specific needs.

So while everybody loves a deal, however you need to also think about client and declares service together with price when comparing car insurer. CarInsurance. com's experts fielded a survey of 3,700 consumers, yielding the following results, with all ratings out of 100. Our best car insurance provider direct has more in-depth rankings that reveal how the top 20 biggest cars and truck insurer rank on metrics of customer support, claims handling, worth and website/app functionality.

How Much Does It Cost To Fill A Cavity With Insurance for Beginners

Make sure to have all automobile insurance discount rates for which you certify applied to your coverage. Common car discount rates include those for purchasing automobile and house insurance coverage from the exact same business, paying in full, paying online, guaranteeing a new vehicle, having specific security features, having more than one cars and truck on a policy, continuing protection for a number of years with the exact same company, having a tidy driving record for a set variety of years and driving couple of miles.

This will generally reduce your rate. Just make certain to have the cash on hand to pay out the deductible ought to you need to submit a claim.Compare car insurance coverage prices quote at least upon renewal of your policy. It is essential to inspect your driving record and fix it if you see any mistakes before looking for coverage since a clean driving record normally indicates low cost vehicle insurance coverage. More secure vehicles have less accidents, so generally are cheaper.

to guarantee. If you do not own a house, have much cost savings or a retirement fund, and your cars and truck deserves less than$ 3,000, buying just basic( 50/100/50 )or state minimum liability protection is typically sufficient. Here's how to enhance your credit-based insurance rating to get cheaper vehicle insurance coverage rates: Pay your expenses on time. Don't max out your credit cards. Keep your credit card balances low. The insurance coverage score thinks about http://elliottxals572.jigsy.com/entries/general/an-unbiased-view-of-what-does-enterprise-car-rental-insurance-cover the amount you owe in relation to your credit line. Don't open brand-new charge card accounts. A lot of brand-new accounts signals difficulty to insurers. Don't cancel all your charge card. The longer you preserve a good credit history, the better - what is short term health insurance. Check the accuracy of your credit report; mistakes will hurt your score. You can ask for totally free copies of your credit reports from the 3 national credit reporting firms through AnnualCreditReport. com. Follow instructions from the agencies to repair any mistakes. If you're struggling financially and can't pay your expenses, get professional finance advice. You may be wondering when it makes sense to buy bare-bones coverage and when you need to actually purchase more insurance to ensure you are economically protected.

Going with the minimum liability automobile insurance coverage needed by your state is rarely recommended. The quantity of protection needed by state law is low, which means even a small accident can surpass the quantity your insurance provider will pay (why is my car insurance so high).

Examine This Report about What Does Full Coverage Car Insurance Consist Of

You have actually researched rates and the health insurance you have actually picked expenses $175 per month, which is your premium. In order to keep your advantages active and the strategy in force, you'll need to pay your premium on Visit this website time each month. Deductible A deductible is a set amount you need to pay every year toward your medical bills before your insurer starts paying.

Your strategy has a $1,000 deductible. That means you pay your own medical costs up to $1,000 for the year. Then, your insurance coverage begins. At the start of each year, you'll need to satisfy the deductible once again. Coinsurance Coinsurance is the portion of your medical bill you share with your insurance provider after you have actually paid your deductible.

You have an "80/20" plan. That indicates your insurance provider pays for 80 percent of your costs after you've satisfied your deductible. You spend for 20 percent. Coinsurance is different and separate from any copayment. Copayment (or "copay") Your copayment, or copay, is the flat charge you pay every time you go to the physician or fill a prescription.

Copays do not count towards your deductible. Let's state your strategy has a $20 copayment for regular medical professional's visits. That implies you need to pay $20 each time you go. Copayments are various than coinsurance. Like any kind of insurance coverage plan, there are some costs that might be partly covered, or not at all.

Less obvious costs might consist of services offered by a medical professional or healthcare facility that is not part of your strategy's network, strategy limitations for specific kinds of care, such as a particular variety of check outs for physical therapy per advantage duration, in addition to over-the-counter drugs. To assist you discover the best strategy that fits your budget plan, take a look at both the obvious and less apparent costs you might expect to pay.

If you have various levels to pick from, choose the greatest deductible quantity that you can conveniently https://writeablog.net/seannaitku/that-additional-72-a-day-suggests-26-000-in-annual-costs-you-do-not-need-to pay in a fiscal year. Discover more about deductibles and how they impact your premium.. Estimate your overall number of in-network physician's check outs you'll have in a year. Based on a plan's copayment, build up your total cost.

Even strategies with thorough drug coverage may have a copayment. Figure in worst timeshare companies dental, vision and any other routine and essential care for you and your family. If these expenses are high, you might want to consider a strategy that covers these costs. It's a little work, however looking at all expenses, not simply the obvious ones, will assist you find the plan you can afford.

More About How Much Does Dental Insurance Cost

Trying to identify your annual health care costs? There are numerous pieces of the expense puzzle you should take into consideration, including your premiums, deductible, coinsurance and copay. Below is a description of each and examples that demonstrate how people use them to spend for healthcare - how much does motorcycle insurance cost. For details on your plan's out-of-pocket costs and the services covered, check the Summary of Benefits and Coverage, which is included in your enrollment materials.

Greater premiums normally indicate lower deductibles. An example of how it works: Trisha, 57, intends on committing herself to her 3 grandchildren after she retires. Knowing she'll require to maintain her energy, she just signed up for a different health care plan at work. The strategy premium, or expense of coverage, will be secured of her incomes.

That is essential considering that Trisha assured her grown children she 'd be more persistent about her own health. Learn more about how health prepares with greater premiums often have lower deductibles. Her brand-new strategy will keep out-of-pocket expenses predictable and workable since as a previous cigarette smoker with breathing issues, she requires to see doctors and experts frequently - how much is adderall without insurance.

In the meantime, she's conserving cash, listening to her doctors and enjoying time with her family on weekends. What is a deductible? A deductible is the amount you pay out-of-pocket for covered services before your health insurance starts. An example of how it works: Courtney, 43, is a single lawyer who just purchased her very first house, a condominium in Midtown Atlanta.

When she felt a lump in her breast throughout a self-exam, she right away had it examined out. Luckily, physicians told her it was benign, but she'll need to undergo a lumpectomy to have it eliminated. Courtney will pay of pocket for the treatment up until she fulfills her $1,500 deductible, the quantity she pays for covered services prior to her health strategy contributes.

In the event she has more medical costs this year, it's excellent to know she'll max out the deductible right away so she will not need to pay complete rate. Learn how you can save cash with a health savings account. What is coinsurance? Coinsurance is the portion of the bill you pay after you satisfy your deductible.

Their 3-year-old recently fell at the playground and broke his arm. The family maxed out their deductible currently, so Ben will be responsible for just a part of the expenses or the coinsurance billed for the procedure to reset and cast the break. With his 20 percent coinsurance, he'll end up paying a couple of hundred dollars for the medical facility visit.

The Only Guide to How To Shop For Car Insurance

Discover out how health center plans can assist you cover expenses before you fulfill your medical deductible. What is copay? Copays are flat charges for certain gos to. An example of how it works: Leon, 34, is a married forklift operator from Jacksonville, FL. He's a devoted runner, however lately has had irritating knee discomfort and swelling.

Thankfully, his health strategy has some set costs and just requires $30 copays for sees to his regular medical professional and $50 copays to see experts like an orthopedist. (He also when paid a $150 copay the night he landed in the emergency space when his knee was so inflamed he could not flex it.) Having these set charges offers Leon peace of mind given that he and Leah are conserving to buy a kayak.

His copays reach physical treatment gos to, where he'll pay $20 for each session. Leon's figured out to get whatever back on track so he and Leah can go back to doing the things they like: hanging out together outdoors. By discovering how premiums, deductibles, coinsurance and copays work, you can better comprehend your healthcare expenses.

Some medical insurance policies need the guaranteed individual to pay coinsurance. Coinsurance means that you will share some portion of the payment for your healthcare bills with your health insurance provider. Hero Images/ Getty Images When you are choosing your medical insurance policy, you might have several options, consisting of a few strategies with the alternative of coinsurance.

3 Easy Facts About What Is The Cheapest Car Insurance Explained

These services are covered even if you became pregnant before your protection starts. For the majority of health insurance plans, you can find the particular way your strategy covers giving birth on page 7 of your Summary of Advantages and Coverage file. Having a child counts as a certifying occasion for a special registration duration in which you can enlist in a new strategy or switch plans.

Maternity care and childbirth are also covered by Medicaid and CHIP. If you get approved for Medicaid and CHIP and are pregnant, you can apply at any time during the year through your state agency or marketplace. If you're above the age of 65, you get approved for Medicare. We enter into more information into Medicare below, however the gist of it is that it's a federal program developed to help you cover health care costs into old age.

Medigap plans may or might not make good sense for you make certain you understand what you're purchasing http://codyebnx110.jigsy.com/entries/general/the-basic-principles-of-how-to-find-out-if-someone-has-life-insurance prior to you start to spend for it. If you're an active service service member, your health care (and your household's healthcare) is covered by TRICARE. You do not require to acquire extra medical insurance to adhere to the ACA.

An Unbiased View of How To Get Insurance To Pay For Water Damage

You can buy private strategies from separate business, if that makes good sense for you and your spouse. You can also acquire a household plan from the market. One of you can likewise be a based on the other's employer-provided health insurance strategy, if that's available. Typically, there are 2 kinds of health insurance: public health insurance coverage (like Medicaid, Medicare, and CHIP) and personal medical insurance.

State exchanges and the federal exchange can use customers both public health insurance and private health insurance. On-exchange personal medical insurance policies are strategies that are offered on government-run exchanges, like a state exchange or health care. gov, the federal exchange. On-exchange plans should cover the 10 vital benefits, plus any additional services that are mandated by your state federal government.

On-exchange private strategies are the only prepare for which premium tax credits and cost-sharing decreases (i. e., federal government subsidies for qualifying candidates) are available. how to fight insurance company totaled car. Off-exchange private medical insurance policies are plans that are offered either directly by the medical insurance business, through a third-party broker, or a privately-run health insurance market.

How To Shop For Car Insurance for Dummies

The caveat with off-exchange strategies is that you can not use any aids (e. g., the exceptional tax credit or cost-sharing decreases) to these plans. Offering an off-exchange plan might enable an insurance provider more flexibility. For example, since they do not need to offer a strategy at every metal tier, insurers can use simply one kind of medical insurance plan.

Employer-provided health insurance coverage strategies, also called group plans, are private strategies acquired and handled by your company. Employer-provided plans need to follow the very same rules as other private insurance strategies and cover the 10 important benefits. Because group health insurance covers a big swimming pool of people, it's typically much more inexpensive than a similar individual strategy.

If you're qualified for an employer-provided plan, you do not need to acquire additional protection through the market. Speak with your human resources department for more particular info about your plan. Short-term health insurance plans offer limited healthcare protection for a short-lived gap in protection. However, it's very essential to note that short-term medical insurance plans do not count as qualifying health protection, and might not supply you with all the protection you require.

The 30-Second Trick For How Much Does A Doctor Visit Cost Without Insurance

Numerous large health insurance companies provide short-term alternatives. However know that short-term health insurance might have limitations that routine health insurance coverage does not have, such as caps on yearly benefits paid. Medicare is a federal health insurance program for Americans above the age of 65 (how much does motorcycle insurance cost). It offers totally free or heavily cost-reduced health care to qualified enrollees.

In 2021, Part B has a regular monthly premium of $148. 50. Part C, which is likewise called Medicare Advantage, and allows you to buy into private medical View website insurance. Part D, for prescription drug coverage. If you're above the age of 65, you can use for Medicare through health care. gov or your state exchange.

Medicaid has eligibility requirements that are set on a state-by-state basis, however it is mostly developed for those with low incomes and low liquid possessions. It is likewise developed to assist families and caretakers of little kids in need. You can generally check if you certify for Medicaid through health care.

The Ultimate Guide To How To Shop For Car Insurance

The Kid's Health Insurance Program (CHIP) is a federal Hop over to this website and state program that resembles Medicaid, but particularly created to cover children listed below the age of 18. The program is mainly aimed at children in households who have earnings too expensive to receive Medicaid however too low to afford private medical insurance.

gov or your state's exchange. how to fight insurance company totaled car. All private medical insurance strategies, whether they're on-exchange or off-exchange, work by partnering with networks of healthcare suppliers. However the manner in which these plans deal with the networks can vary substantially, and you want to make certain you understand the distinctions in between these plans.

If you have an HMO plan, you'll be asked to pick a main care doctor (PCP) that is in-network. All of your care will be coordinated by your PCP, and you'll need a referral from your PCP to see a professional. HMOs do not cover any out-of-network healthcare expenses.

The How Much Does Home Insurance Cost Statements

PPO prepares are the least restrictive kind of plan when it concerns accessing your network of companies and getting care from outside the strategy's network. Normally, you have the alternative in between choosing in between an in-network medical professional, who can you see at a lower expense, or an out-of-network medical professional at a greater cost.

PPO strategies generally have more expensive premiums than other types of personal medical insurance strategies. EPO plans are a mix between HMO plans and PPO strategies. EPO plans give you the choice of seeing a specialist without a recommendation. Nevertheless, EPO strategies do not cover out-of-network doctors. EPO strategies normally have more costly premiums than HMOs, however cheaper premiums than PPOs.

You'll have a medical care provider on an HMO-style network that can collaborate your care. You'll likewise have access to a PPO-style network with out-of-network alternatives (albeit at a greater expense). The HMO network will be more cost effective, and you will need to get a recommendation to see HMO professionals.

Excitement About What Is The Minimum Insurance Requirement In California?

Find out more about the differences in between HMOs, PPOs, EPOs, and POS strategies. Remember previously when we talked about how all health insurance coverage plans divided some of the costs between the insurance company and the consumer? Metal tiers are a fast way to categorize strategies based on what that split is. Some people get puzzled because they believe metal tiers describe the quality of the strategy or the quality of the service they'll receive, which isn't true.

These portions do not take premiums into account. They likewise do not represent the precise amount that you'll actually spend for medical services. In general, Bronze strategies have the most affordable monthly premiums and Platinum have the greatest, with Silver and Gold occupying the price points in between. As you can see from the cost-sharing split above, Bronze plan premiums are cheaper since the consumer pays more expense for healthcare services.

Some Known Questions About What Is Bond In Finance.

Working in developed banks and businesses such as Morgan Stanley, JP Morgan, Credit Suisse and Citi provides you the chance to take advantage of structured training and development opportunities which have been tried and evaluated throughout the banks' long history. At the exact same time, depending on the route you take, you'll likewise have the ability to acquire an expert certification as you advance in your profession.

The average beginning salary for a graduate in Financial investment Banking is 45,000 - double the graduate average. Big banks normally provide a https://www.inhersight.com/companies/best/reviews/overall wealth of other advantages consisting of private healthcare, insurance coverage, subsidised travel, food and health club subscription. Great benefits are not simply https://fortune.com/best-small-workplaces-for-women/2020/wesley-financial-group/ the preserve of the banking and finance sector, however what makes the remuneration in this market stand out is the chance for substantial and rewarding rewards. how to get a car on finance.

Some Ideas on A City Could Issue Which Type Of Bond? Quizlet You Should Know

Table of ContentsOur What Is Derivative Instruments In Finance PDFsRumored Buzz on What Is A Derivative In.com Finance

That year's weather provided way to a bumper crop of timeshare rentals las vegas olives and it made him a lot of cash in a very early variation of what we 'd now call a forward agreement. In the 19th century, US farmers were having problems discovering buyers for their commodities. To solve the concern, a joint market was set up in 1848 called the Chicago Board of Trade (CBOT). A derivative is a contract in between 2 celebrations which derives its value/price from a hidden property. The most typical types of derivatives are futures, alternatives, forwards and swaps. It is a financial instrument which derives its value/price from the underlying possessions. Initially, underlying corpus is very first produced which can consist of one security or a combination of various securities.

Derivatives are monetary contracts whose worth is linked to the value of a hidden propertyKinds of Possessions. They are intricate monetary instruments that are utilized for different functions, including hedgingHedging Arrangement and getting access to additional possessions or markets. Most derivatives are traded over-the-counter (OTC)Over-the-Counter (OTC). However, some of the agreements, consisting of choices and futures, are traded on specialized exchanges.

Derivatives are not brand-new monetary instruments. For example, the introduction of the first futures contracts can be traced back to the 2nd millennium BC in Mesopotamia. However, the monetary instrument was not commonly used up until the 1970s. The introduction of new appraisal techniques sparked the fast advancement of the derivatives market.

These are monetary contracts that obligate the agreements' buyers to buy a possession at a pre-agreed cost on a specified future date. Both forwards and futures are essentially the very same in their nature. what is a how to get rid of timeshare legally derivative in finance. However, forwards are more flexible agreements due to the fact that the celebrations can tailor the underlying product as well as the quantity of the orlando timeshare rent commodity and the date of the deal. what is a derivative finance baby terms.

What Is A Derivative Finance - Truths

Choices provide the purchaser of the contracts the right, however not the obligation, to acquire or offer the hidden asset at a fixed rate. Based on the choice type, the buyer can exercise the option on the maturity date (European alternatives) or on any date before the maturity (American options). Swaps are acquired contracts that enable the exchange of cash streams between 2 parties.

The most popular kinds of swaps are interest rate swapsRate Of Interest Swap, product swaps, and currency swaps. Unsurprisingly, derivatives put in a substantial influence on modern finance because they offer various advantages to the monetary markets: Because the value of the derivatives is connected to the value of the hidden asset, the contracts are mainly used for hedging dangers - finance what is a derivative.

In this way, revenues in the acquired agreement may balance out losses in the underlying possession. Derivates are regularly used to figure out the cost of the underlying possession. For instance, the spot rates of the futures can serve as an approximation of a product rate. It is thought about that derivatives increase the efficiency of monetary markets.

Excitement About Which Of These Is An Element Of A Bond Personal Finance

If you're a real estate professional looking for advertising and growth chances, click the discover more button listed below. If you decide to go with a standard loan provider or are dealing with a brand-new loan provider for the very first time, you'll require to establish who you are, what your intents are and why you're credible.

Your lending institution will initially would like to know your debt-to-income ratio. This will change depending on the number of rental homes you have (where can i use snap finance). The lending institution will likely add a percentage of your rental earnings to your total earnings to help determine your ratio; however, the percentage varies by lender. Your lending institution will also think about the worth of the residential or commercial property and the quantity of cash you have for a deposit.

While you need at least 20 percent for your first rental residential or commercial property, when you have 5 or more residential or commercial properties the bank may request a higher down payment, e. g. 35 percent. Keeping your financial resources in good shape will reinforce your argument. Unlike a mortgage on a primary home, you should deal with the mortgage process for your financial best company to sell timeshare investment home as an organization since it is.

The objective is to much better assist them understand the roi for this property. You'll wish to include info such as: Money flowCap rateCash on cash returnAppreciation rates in the areaRental demand in the marketPutting this info together in an easy-to-read company strategy will help your case with lending institutions. The majority of homebuyers turn to standard lending institutions to secure financing for their primary residence.

Common loan providers will assist you with the timeshare promotion orlando first number of investment homes you purchase, however they aren't ideal resources for your service. Known for their conservative methods, big banks and standard lending institutions aren't eager to assist investors protect more properties. Rather, you'll require to discover a lender with experience loaning to investors.

The 8-Minute Rule for How To Finance A Startup Business

They comprehend that you are using take advantage of to grow your wealth. They are less likely to be scared of the threat and aspire to participate generating income from your income-generating venture. More than giving funding, the ideal loan provider can be a valuable member of your team.

This individual is a sounding board for any concerns with your financing or ideas for securing the next residential or commercial property. They will help you produce a timeline for settling existing home loans and finding brand-new ones. An excellent lending institution https://b3.zcubes.com/v.aspx?mid=6860699&title=the-facts-about-what-is-bond-rating-finance-revealed can operate as an advisor in growing your organization. Growing your wealth rapidly with genuine estate investing needs financing several properties at when.

All you require is a little bit of preparation and research. For endless rental residential or commercial properties we suggest our sister business LendCity Mortgages which was built for investors. Intrigued in Rental Property Funding!.?.!? If so, call us and we will show you how you can buy limitless rental residential or commercial properties with excellent rates.

After thousands of effective offers between flips, lease to owns, student homes and business assets I have actually developed a deep knowledge of property financial investments and have an enthusiasm of sharing this info with the world! If your looking for a lending institution who concentrates on rental residential or commercial property financing you're going to wish to get in touch with me at team@lendcity.

There are lots of factors to buy genuine estate. It can be a hedge against market volatility when stocks take a tumble, and there are also numerous perks associated with owning an investment home. how much negative equity will a bank finance. Becoming a property manager may be a wise method to create a consistent passive earnings stream, however it does take a particular amount of money to start.

The Main Principles Of How To Finance A Private Car Sale

Financial investment residential or commercial property financing can take numerous kinds, and there are particular criteria that borrowers require to be able to meet. Selecting the wrong sort of loan can impact the success of your financial investment, so it's essential to understand the requirements of each sort of loan and how the different alternatives work prior to approaching a lending institution.

There are a couple of ways to fund investment residential or commercial properties, including utilizing the equity in your personal house. If you don't have the money to fund a downpayment yourself, it might possible to utilize gifted funds, however the presents of cash need to be documented. Buying residential or commercial properties and refurbishing them to resell for an earnings is called flipping in real estate lingo.

Banks do not provide hard cash loans, just conventional home loans. If you currently own a house that's your primary home, you're probably familiar with traditional financing. A conventional home mortgage complies with standards set by Fannie Mae or Freddie Mac and unlike an FHA, VA, or USDA loan, it's not backed by the federal government.

With a traditional loan, your personal credit score and credit history determine your capability to get authorized, and what kind of rates of interest applies to the mortgage. Lenders likewise review debtors' earnings and properties. And clearly, customers need to have the ability to reveal that they can afford their existing home mortgage and the month-to-month loan payments on a financial investment home.

While being a property owner has its perks, it also includes particular headaches. For some investors, turning houses is the more attractive option due to the fact that it permits them to receive their earnings in a lump sum when your home is sold, rather than waiting on a rent inspect each month. A fix-and-flip loan is a kind of short-term loan that allows the customer to complete renovations so the house can be returned on the market as quickly as possible.

Not known Facts About What Is The Lowest Credit Score Nissan Will Finance

Difficult money loan providers focus on these type of loans, however certain property crowdfunding platforms use them also - why is campaign finance a concern in the united states. The benefit of using a hard cash loan to finance a house flip is that it may be simpler to qualify compared to a traditional loan. While lending institutions do still think about things like credit and income, the primary focus is on the residential or commercial property's profitability.

It's likewise possible to get loan financing in a matter of days rather than waiting weeks or months for a traditional home mortgage closing. The biggest disadvantage of utilizing a fix-and-flip loan is that it won't come cheap. Rate of interest for this type of loan can go as high as 18%, depending upon the lending institution, and your timeframe for paying it back may be brief.

What Is Principle In Finance Bond Things To Know Before You Get This

Table of ContentsWhat Is A Bond Pread Finance - TruthsIndicators on What Is Bond In Finance With Example You Need To Know

are issued by government-affiliated companies. Most bonds share some standard attributes including: is the quantity that the bond will be worth at maturity. Bond providers bluegreen timeshare for sale utilize the face value of the bond to determine the interest payments. a bond has a face worth of $1000 a purchaser purchases the bond at a premium of $1050.

At the maturity of the bond, both investors will receive $1000 which is the stated value of the bond. is the rate of interest of the bond, this interest is calculated on the stated value of the bond. The rate of interest is revealed as a portion. a $1000 face worth bond with an 8% voucher rate is provided.

Interest payment can be made at different intervals, however the requirement is semi-annual payments. is the date at which the stated value of the bond will be paid to the bondholder.is the cost that the bond was initially cost. The marketplace price of a bond depends on various elements: the credit ranking of a company's bond is determined by credit ranking firms. what is zero coupon bond in finance.

Really high-quality bonds are released by steady companies and they are called investment-grade bonds. If the credit quality of the issuers is bad, then it increases the threat of the bond these bonds are called high yield or junk bonds. The bonds will pay a greater interest rate due to the risk - what is principle in finance bond.

In Order To Finance A New Toll Bridge Things To Know Before You Buy

Greater interest rates will be paid to the shareholder since the bond is exposed longer to varying interest and inflation rates. will be compared to the basic rates of interest at the time of releasing the bond. You can use our bond worth Excel spreadsheet to compute your bond prices, valuation and yield.

They are separated by the rate, kind of interest or the voucher payment of the bond. Let's talk about the ranges of bonds: http://spencerdgun305.theburnward.com/the-ultimate-guide-to-how-to-find-bond-interest-rate-in-yahoo-finance are released at a discounted value, they do not pay any coupon payment. The bondholder gets a return when the bond matures, and the stated value is paid out.

a company needs $2 million to fund a brand-new expansion task. The business can release bonds with a 10% discount coupon rate that develops in ten years. The option is to provide a 6% voucher with the capability to transform the bond into equity if the cost of the stock rises above a particular value. The rankings are designated by credit ranking firms such as Moody's, Standard & Poor's, and Fitch. Rankings to have letter classifications (such as AAA, B, CC), which represent the quality of a bond. A bond is considered financial investment -grade (IG) if its credit score is BBB- or timeshare exit attorneys higher by Standard & Poor's, or Baa3 or higher by Moody's, or BBB( low) or higher by DBRS.

: A credit ranking company (CRA) is a business that designates credit scores to issuers of particular types of debt obligations, in addition to to the debt instruments themselves. In investment, the bond credit rating evaluates the credit value of a corporation's or government's financial obligation concern. The credit rating is comparable to a credit score for people.

What Does How To Find Bond Price On Yahoo Finance Mean?